What Meta’s $251 billion market cap rout teaches about investing

[ad_1]

A version of this post was originally published on TKer.co.

Just because the stock market usually goes up doesn’t mean that all stocks always go up.

One stock that didn’t go up last week was Facebook parent Meta Networks (FB).¹ After reporting disappointing quarterly results on Wednesday, the company’s shares plunged 26% in a single trading day. After losing an eye-popping $251 billion of market cap, the social networking company quickly went from being the fifth largest company in the S&P 500 to the seventh.

It’s the kind of move that could’ve rattled the confidence of investors and traders with positions in other stocks. And it did: That same day, the S&P 500 fell 2.4%.

But losing 2.4% isn’t remotely close to losing 26%. That’s diversification at work. By investing in a variety of assets that aren’t perfectly correlated, you limit the ability of a single stock to ruin your finances.

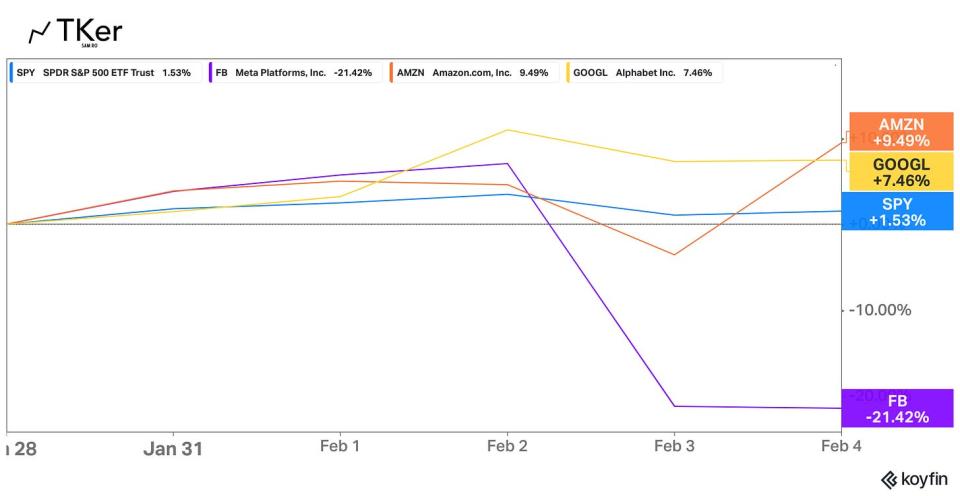

Zooming out a bit, the S&P 500 actually gained 1.5% for the week while FB shares lost 21.4%. Diversification is looking pretty great right now.

Of course, there is an opportunity cost.

Investors who are diversified through index funds like SPY didn’t fully experience the jumps in Alphabet and Amazon, which gained 7.5% and 9.5%, respectively, last week following strong financial results.

Now, I’m not going to tell you not to try your hand at picking stocks. How you invest your money is up to you.

But before you decide to abandon index funds as you try to get in front of the next Alphabet or Amazon, keep in mind there is an entire industry of professionals trying to beat the market this way. And most of them fail to do so, year in and year out.

Few market observers, if anyone, could’ve confidently told which stocks would surge and which stock would fall last week. However, the historical data says when you’re invested broadly in the stock market — understanding that you’ll have exposure to both winners and losers in the market — you’ll probably be pleased over time.

That’s because over time, the stock market as a whole usually goes up.

Some recent stock market features from TKer:

Rearview 🪞

📈 Stock market rally: The S&P 500 climbed 1.5% last week. It’s down 5.6% since the beginning of the year but up 16.2% from 12 months ago. For more on market volatility, read this.

🎉 Jobs surprise: The U.S. economy added 467,000 jobs in January, which was much stronger than the 125,000 gain expected. Additionally, the previously reported November and December estimates were revised up by 709,000. “The feared disruption of the labor market from the omicron variant was not as bad as expected in January,“ Nick Bunker, economic research director at Indeed Hiring Lab, wrote on Friday.

🎉 A bullish jobs detail: From MacroPolicy Perspective’s Julia Coronado: “The number of people working part time but wanting full time work fell again in Jan to…

[ad_2]

Read More: What Meta’s $251 billion market cap rout teaches about investing