EWJV ETF: Japanese Value Stocks Are A Diversifier

[ad_1]

yongyuan/E+ via Getty Images

iShares MSCI Japan Value ETF (NASDAQ:EWJV) is an exchange-traded fund enabling investors to get exposure to mid- and large-cap Japanese stocks that trade at relatively low valuations. The fund had assets under management of $94.57 million as of Feb 18, 2022 (across 156 holdings) indicating a low level of popularity, although the fund is also relatively new to the market, launched in March 2019. The expense ratio is currently quite low for an iShares fund; 0.15%.

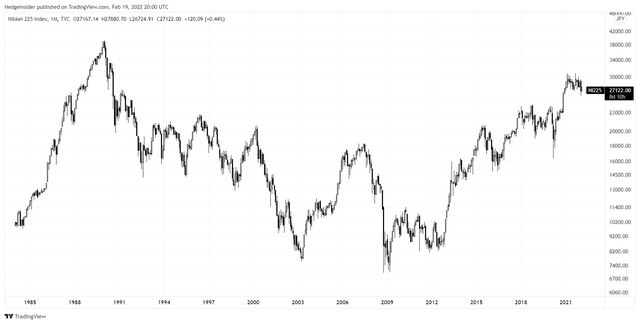

Japanese stocks are not known to perform well. The broader Japanese equity index, the Nikkei 225, peaked in a stock market bubble (that subsequently crashed) at the very end of 1989.

Since then, the performance has been poor. It is not fair to compare present prices to the 1989/90 peak, which was the result of ridiculous valuation multiples being applied to Japanese corporate earnings. Nevertheless, Japan has never been known to generate especially high returns on equity. For example, the MSCI Japan Index implies a forward ROE of 10.27% at present, while the MSCI USA Index carries an implied forward ROE of 22.74%. So, on a market-cap-weighted basis, “Corporate America” is over 2x more efficient than Japanese corporates (in aggregate).

The United States is home to many highly productive corporations, including some of the best-known growth stocks. Japan has its technology sector too, but generally speaking, the corporate culture is more focused on cost-cutting, efficiencies, and stability (rather than innovation via risky research and development spending, investment in software and intangibles, platform building, network effects, etc.). More specifically, EWJV’s fund tracks the MSCI Japan Value Index, which carries an even lower forward ROE of 9.27%.

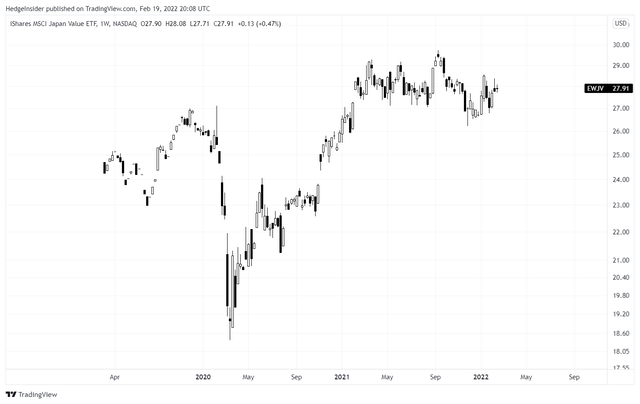

That is a significant part of the problem with investing in “cheap” stocks, or regions. Japan’s interest rates may be low, but the equity risk premium is still roughly on par with the rest of the developed world. Investors demand returns, and if companies are not productive enough to scale their earnings and compound their book values at certain rates, stock prices will not budge much. EWJV has recovered from its March 2020 lows (following the emergence of COVID-19), but I would not expect a dramatic forward performance.

Still, the dividend yield is quite good; 2.55% on a 30-day SEC yield basis, calculated by iShares as of Jan 31, 2022 (12-month trailing yield: 2.40%). However, to reiterate, the fund is not a “growth fund”; at higher dividend yields, you can likely expect to see less capital appreciation.

On the other hand, while I might have expected a value-oriented portfolio as including mostly characteristically low-growth sectors, EWJV does have some decent exposure to both “Cyclical” and “Sensitive” sectors (20.23% Consumer Cyclical, 18.77% Industrials, etc.). The fund being “under-weight” Defensives does make me feel more confident in the potential for the fund to…

[ad_2]

Read More: EWJV ETF: Japanese Value Stocks Are A Diversifier