Will Fed rate hikes crush the stock market? Here’s why speed matters

[ad_1]

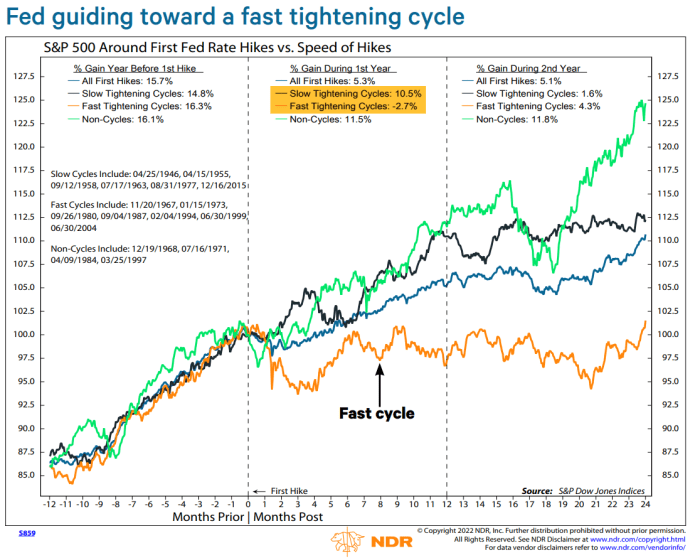

With the Federal Reserve all but certain to begin raising interest rates in March, market prognosticators have been quick to reassure investors that history shows stocks tend to do just fine as policy makers embark on a monetary policy tightening cycle.

But like most things related to markets, there’s more to the story.

It turns out that when the Fed moves fast to hike rates, as it has signaled it’s prepared to do in a scramble to rein in U.S. inflation running at its hottest since the early 1980s, the stock market’s short-term performance hasn’t been quite as stellar, said Ed Clissold, chief U.S. strategist at Ned Davis Research.

“It’s intuitive that the Fed’s job when they start to raise rates is to take the punch bowl away before the party gets going too much,” he said, in a Thursday interview. So it shouldn’t be a surprise that “the quicker they’ve been, the more markets have taken note.”

Clissold and Thanh Nguyen, NDR’s senior quantitative analyst, detailed the difference between market performance in “fast” versus “slow” cycles in a Feb. 9 note. They found that in the year following the initial rate increase, the S&P 500

SPX,

rose an average 10.5% in slow cycles versus an average fall of 2.7% in fast cycles (see chart below).

Ned Davis Research

The median gain during the first year of a slow cycle was 13.4% versus 2.4% for fast cycles. The median maximum drawdown in slow cycles was 11%, compared with 12.1% for fast cycles.

Overall, the “return and drawdown statistics of a fast cycle are consistent with choppy conditions, but not necessarily a major bear market,” Clissold and Nguyen wrote.

So how fast is fast? It’s a bit subjective, Clissold told MarketWatch, but past cycles have shaken out relatively clearly between the two categories. NDR expects four or more rate increases over the Fed’s seven remaining policy meetings in 2022 alongside the start of a reduction in the size of the central bank’s balance sheet — a pace that would put the cycle clearly in the “fast” category.

Some Fed watchers see a faster pace than that, and fed-funds futures traders have increasingly priced in the prospect of policy makers kicking off the cycle with a half-point rate increase rather than the typical quarter-point, or 25 basis point, move.

The market’s pricing of an aggressive rate-hike scenario appears reasonable given the inflation picture, said Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

That said, it’s worth remembering that…

[ad_2]

Read More: Will Fed rate hikes crush the stock market? Here’s why speed matters