Week 7 MDA Breakout Stocks – February 2022: Short-Term Picks

[ad_1]

deimagine/E+ via Getty Images

Introduction

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This subset of the different portfolios I regularly analyze has now reached over 240 weeks of public selections as part of this ongoing live forward-testing research.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate 4 selections each week, 2 Dow 30 picks, and new portfolios for ETF/ETNs and monthly Growth & Dividend MDA breakout stocks. I offer 11 top models of short and long term value and momentum portfolios that have beaten the S&P 500 since my trading studies were made public:

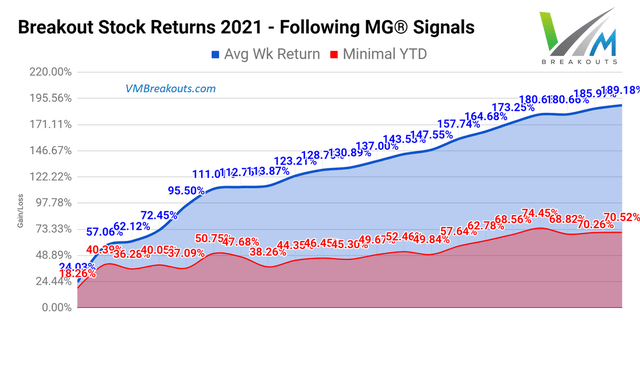

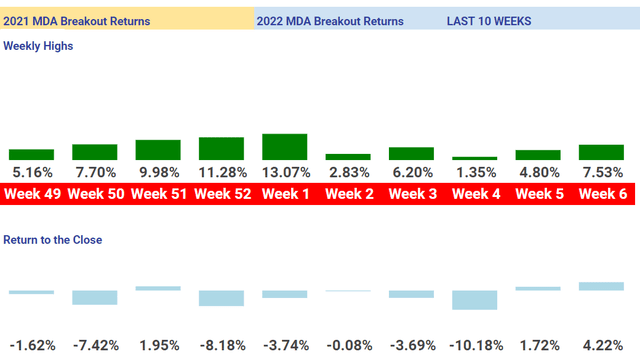

Charts and tables will restart for 2022 when we get at least one positive trading signal week. MDA Breakout returns are still at 0% following the Momentum Gauge® signals and avoiding the worst January start to the stock market since 1939. It is best to follow the signals as we enter February with continuing negative signals and 13 consecutive weeks of negative signals since November. February is historically the second worst month of the year for the S&P 500 on average since 1927. We still have had no positive weekly signals so far in 2022 and last year there were only 21 positive trading weeks to achieve +70.5% returns:

Returns from 21 Weeks of Positive Momentum Gauge signals in 2021

Still waiting for a positive signal in 2022.

Momentum Gauge® trading signal: Negative conditions ahead of Week 7

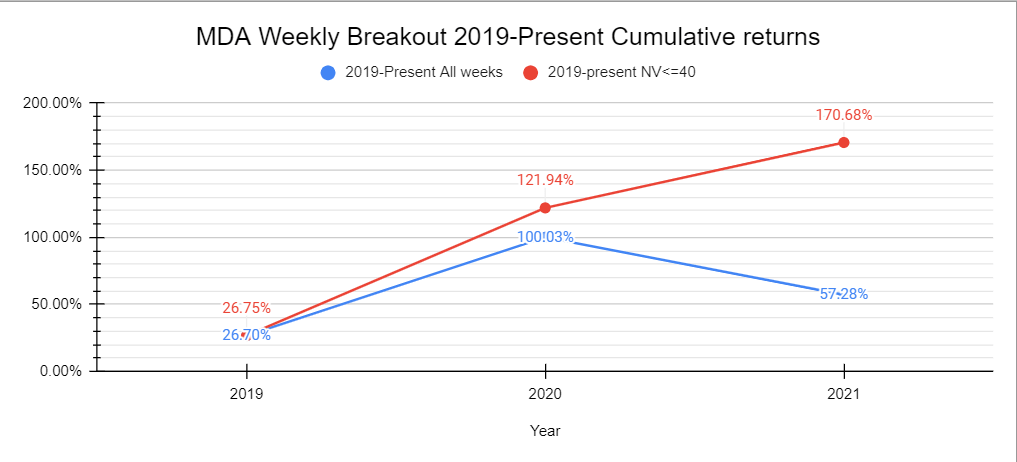

Readers should consider carefully the difference in return performance of momentum stocks over the years while the Momentum Gauges® have high negative values above 40.

(Source: VMBreakouts.com) Red weekly color the last 10 weeks shows how poorly market momentum and investor enthusiasm sustains through the week when the negative Momentum Gauges® are above 40. This was an especially strong factor in 2021 showing cumulative returns with and without the signal.

VMbreakouts.com

Historical Performance Measurements

The MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

Longer term many of these selections join the V&M Multibagger list now up to 144 weekly picks with over 100%+ gains, 58 picks over 200%+, 19 picks over 500%+ and 3 picks with over 1000%+ gains since January 2019 such as:

- Intrepid Potash (IPI) +1,241.6%

- Celsius Holdings (CELH) +1,109.6%

- Trillium Therapeutics (TRIL) +1008.7%

More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are…

[ad_2]

Read More: Week 7 MDA Breakout Stocks – February 2022: Short-Term Picks